As defined over, the Form 8865 is late or delinquent if it scheduled however not filed prompt. For all tax years from 2007 ahead, it will always be due up until filed, and if not timely submitted, a delinquent Form 8865 can always be examined the major IRS penalties described listed below.

This is an obstacle that we will quickly see is finest fulfilled by a Form 8865 tax attorney. A Form 8865 filing may be examined by the IRS any time within the statute of constraints. While extremely not likely, a timely-filed Form 8865 might be found so insufficient or incorrect that maybe dealt with as a failing to file and subject the US individual to Form 8865 penalties.

In all instances (filing or non-filing), the IRS’ focus in a Form 8865 audit is whether the failure to file a prompt, correct and also total Form 8865 is. If affordable reason exists, the IRS might not enforce a Form 8865 fine. This indicates, implicitly, that the Form 8865 penalty program is detached to whether the failing to file the Form 8865 was unyielding or negligent.

The failing to timely documents a Form 8865 (or prompt filing a Form 8865, yet one which was wrong or insufficient) goes through a $10,000 charge for each year of disobedience. As an example of the huge possible dimension of Form 8865 penalties, think about an US person who had a 70% interest in a foreign partnership for the last ten reporting years, and failed to file the Form in each of those years.

Filing Form 5471 As Us Owner Of Foreign Corporations – 1040 … in Torrance, California

This huge charge is feasible, certainly, since while the taxpayer may have filed Form 1040 tax returns in each of the last 10 years, he did not file the Form 8865 and also the failing to submit the Form 8865 suggests that from 2007 onward, the statute has never run out, both as to the Form 8865 as well as the income tax return itself.

It allows the IRS to analyze any kind of various other penalty, and also any kind of quantity of overdue tax, from every income tax return year from 2007 onward. The most usual monetary threat from this arrangement is that under United States tax law, foreign partnerships are typically quite profitable as well as would certainly have (if effectively reported) been needed to report as well as pay considerable revenue tax.

(Although an unyielding failure to file a Form 8865 may be penalizable under various other general Internal Revenue Code provisions, such as a deceptive return filed with the IRS, a false declaration to the IRS, etc.) To recognize affordable reason, it will be helpful to contrast it against the lawful concept of.

By comparison, can (generally and also simplistically) be said to exist where there was no reasonable path to come to be conscious of a commitment. At a bare minimum, it requires that the taxpayer have missed out on no reasonably-apparent hints to his or her commitment, specifically ideas that she or he documentably experienced at any kind of point.

For American Expats: A U.s. Tax Form Checklist in Joliet, Illinois

By comparison, quality fact-gathering and also argumentation can encourage the IRS that a taxpayer who fell short to adhere to even more odd Form filing responsibilities (like the Form 8865) however did fulfill the affordable cause requirement of exercising ‘average organization treatment as well as prudence.’Remarkably, we believe that the activities of the ordinary United States taxpayer would certainly satisfy this ‘normal business care and also prudence’ requirement.

Consequently, we can state (once again, generally and simplistically) that the sensible cause requirement needs the taxpayer act in an above-average fashion arguably in a way well over that of the ordinary US taxpayer.’Requirement’ IRS fine reduction is readily available for three kinds of usual Form 1040 charges the failure-to-file, failure-to-pay, and also failure-to-deposit tax fines.

Rather, we discuss them below to assist the nonprofessional in recognizing that for overdue or incorrect/incomplete Form 8865 filing. This needs confirming sensible reason. While Form 8865 changes are rare, there are specific circumstances in which it may come to be needed or a minimum of advisable to change an initial and timely-filed Form 8865 possibly the filer receives rehabilitative resource files from the foreign partnership, or discovers that his calculations of earnings (as initially reported) were wrong.

Senior Tax Analyst – Global Tax Accounting At Aptiv in Medford, Massachusetts

Senior Tax Analyst – Global Tax Accounting At Aptiv in Medford, MassachusettsTherefore, we typically suggest that when submitting a Form 8865 amendment, the filer additionally send (literally connected to the amendment) a thorough lawful argument for why it is not the filer’s mistake that the original filing consisted of inaccurate, incomplete, or missing info. Such a statement must mention to the principles of sensible cause as described over without a doubt, we can call it, for simpleness, a.

How To Successfully Request Irs Penalty Relief – Freeman Law in Lexington, Kentucky

Therefore, the individual filing a changed Form 8865 ought to highly consider seeking advice from and/or hiring a Form 8865tax legal representative. This attorney will certainly initially take into consideration the important concern of whether to submit a change in any way. If this is the finest path, the attorney will certainly additionally gather truths, use the law to these truths, as well as inevitably create the required sensible reason declaration to prevent Form 8865 charges.

As readers of this site know, the United States taxes its people (consisting of deportees that live as well as work abroad) as well as legal permanent locals (LPRs) on their globally earnings. Regardless of where in the world your income is derived, the United States government wants its item, as well as it obtains what it desires via a system understood as “citizenship-based taxes.” Whether this is moral is an argument for afterward, however till it alters, those working under this difficult tax system must adhere to all its rules or encounter the consequences of non-compliance.

What is a Partnership? Prior to we study Form 8865 itself, allow’s very first have a look at just how the IRS specifies the term “collaboration.” The IRS defines a collaboration as “the relationship existing in between 2 or even more individuals who join to carry on a trade or service. Each individual contributes money, building, labor or skill, and anticipates to share in the earnings and also losses of the organization.” Unlike firms, whose profits are strained independently from its proprietors, a partnership is a “pass-through entity.” In tax-speak, this means that the partnership itself does not pay any type of tax, however the earnings are passed via to the private partners that then report it on their personal tax returns.

Treasury Inspector General For Tax Administration in Conway, Arkansas

Consequently, due to the US system of citizenship-based tax, all US individuals entailed in a foreign partnership are needed to report the task of that collaboration to the IRS and after that pay tax obligations on their share of the partnership’s earnings. All US persons included in a foreign collaboration are needed to report the task of that partnership to the IRS.

United States Individual For United States tax functions, a United States person is a person or resident of the United States, a domestic collaboration, a domestic firm, and also any estate or trust that is not foreign. To find out more on what comprises an US individual for tax factors, inspect out our write-up on this topic as well as our post on the Significant Presence Examination.

Passion In the context of partnerships, the term “interest” generally describes your level of net investment income tax in a partnership. 50% interest in a collaboration is equal to (a) 50% of the resources, (b) 50% of the profits, or (c) 50% of the deductions or losses. Positive possession regulations additionally apply in identifying 50% passion.

Who Demands to File Form 8865? For the many component, you will likely need to submit Form 8865 if you are a United States person who is entailed in a foreign collaboration.

Filing Form 5471 As Us Owner Of Foreign Corporations – 1040 … in Las Cruces, New Mexico

, the ordinary exchange price for the taxed year ought to be used for conversion. The IRS has no main exchange rate, yet in basic, it accepts any uploaded exchange rate that is utilized constantly.

The Treasury’s page includes both current as well as historic rates. When as well as Where to Submit Form 8865 In order to properly submit Form 8865, you need to connect it to your earnings tax return (or the partnership’s or exempt company’s return) and also file both by the due date (consisting of extensions) for that return.

Cpa Global Tax & Accounting Pllc in Rosemead, California

Cpa Global Tax & Accounting Pllc in Rosemead, CaliforniaFounded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

If you don’t need to file a revenue tax return, after that you need to file Form 8865 independently with the IRS by mid-April when most US earnings tax returns are due. Penalties for Failing to Submit The IRS doesn’t allow those who fall short to file tax files, so you need to be sure to file Form 8865 in a prompt way to prevent severe fines.

The penalties for falling short to submit Form 8865 are separated according to which group of filer you drop under. Charges are dollar quantities that are often combined with a percent decrease of tax benefits, as complies with: For classification 1 filers, a $10,000 penalty is enforced for every tax year the form was not submitted.

What Happened To My Capital Account? New Partnership … in North Richland Hills, Texas

10% might appear light, however if the value of the payment was $1 million, the fine would be $100,000 the ceiling of this penalty. Group 4 filers must file Form 8865 for any type of “reportable occasion” which happened throughout the tax year, including acquisitions, personalities, and adjustments in proportional rate of interest.

GILTI earnings goes through average government revenue tax rates (instead than funding gains rates, for instance), so tax prices for GILTI can be as high as 37%. The types of companies that could be most impacted by GILTI include those where profit is high loved one to its fixed asset base, such as services firms, procurement and distribution business, and also software as well as modern technology business.

Form 8865 is a form related to Income tax return for Foreign Collaborations – offshore asset protection strategies. It is to be submitted each year by all United States people and legal long-term homeowners who have a rate of interest in a foreign collaboration. According to the IRS, a collaboration is a connection that exists between 2 or even more people that integrate for the objective of trade or company.

The “companions” likewise delight in the earnings of business or collaboration or birth the losses from business. A partnership is dealt with by the IRS as a “pass-through” entity. This primarily indicates that the collaboration itself does not pay tax obligations for the revenue produced. Instead, the companions that form the collaboration have to report the earnings in their individual tax returns.

Federal Register/vol. 86, No. 6/monday, January 11, 2021 … in Silver Spring, Maryland

Such a foreign collaboration is still dealt with as a pass-through entity by the IRS for tax purposes. Any kind of US residents or legal permanent citizens are required to upgrade the IRS concerning their foreign partnership’s task and also pay taxes on any type of income which such collaborations generate. The tax obligations to be paid by the United States person will remain in proportion to the share that such an individual holds in the foreign partnership.

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

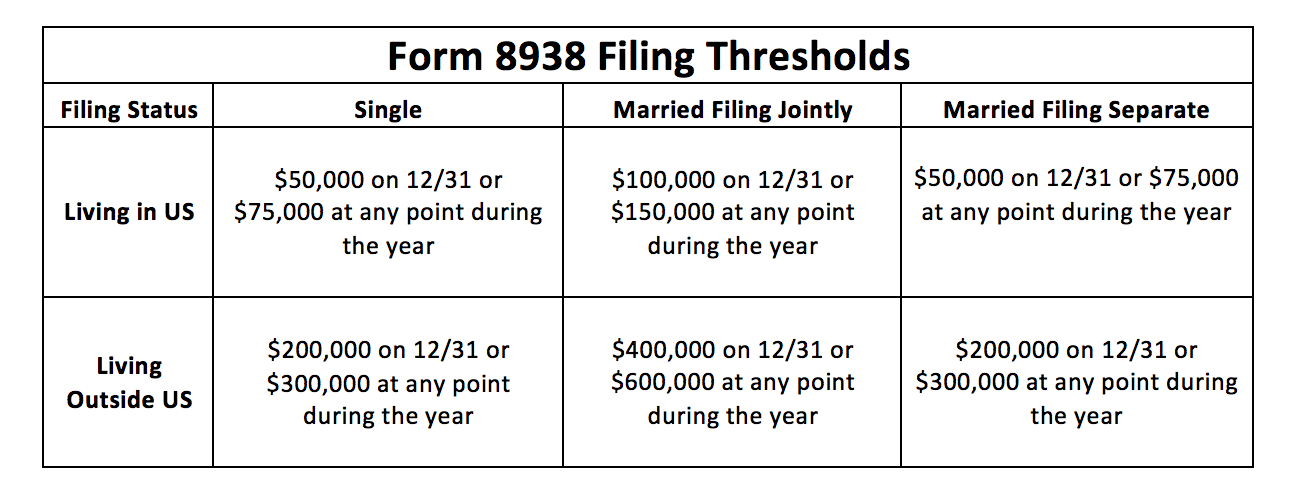

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

Group 3, that includes: 1) A United States individual who has a 10% or more interest in a foreign partnership instantly after having actually contributed residential property to that collaboration in exchange for a share in that collaboration. The worth of the residential property added ought to be $100,000 or more. The $100,000 valuation additionally consists of any contributions made by that individual or a related individual during a 12-month period prior to the transfer day.