g. company revenue, personal revenue, genuine building.– Term used to specify an incident which impacts the obligation of a person to tax.– Taxes are imposed by reference to an amount of time called the “taxable duration”. Tax year– The period (generally one year) during which the tax responsibility of a specific or entity is calculated.

– Document released to a taxpayer by the tax authorities accrediting that the taxpayer has actually either paid all tax obligations due or that he is not accountable to any type of taxes. In specific countries a tax clearance certificate should be created before an individual can leave the country. TAX CONFORMITIES– Degree to which a taxpayer complies (or falls short to abide) with the tax rules of his country, for instance by declaring earnings, submitting a return, and also paying the tax due in a timely manner.

Global Tax – Accountant in Kingston, New York

Global Tax – Accountant in Kingston, New York– The procedure of applying a lien versus residential or commercial property for non-payment of delinquent real estate tax.– It is typical to develop special forms for taxpayers to state their taxed earnings, sales, and so on for tax functions. Forms are made to assist in the job of the tax authorities in assessing and accumulating tax, and also will normally attract the taxpayer’s interest to any kind of alleviation he might claim, etc.

International Year-end Planning Considerations For Taxpayers in Henderson, Nevada

– Area within the area of a nation in which customizeds responsibilities as well as other sorts of indirect tax obligations are not used.– Tax haven in the “classical” feeling refers to a nation which imposes a low or no tax, and is made use of by firms to prevent tax which or else would certainly be payable in a high-tax country.

– The main residential sources of tax legislation are key regulation, such as acts or laws, and additional regulations such as policy, decisions, advertisements, orders, and so on. The primary international sources of tax law are reciprocal or multilateral treaties, as well as one vital resource for the analysis of treaties is the OECD model tax treaty and also the coming with commentary.

International Journaltm – Fenwick & West Llp in Tinley Park, Illinois

– The charging of tax on tax-inclusive rates.– In some nations taxpayers are given a recognition number which have to be utilized when submitting an income tax return and also assessing taxes and for all various other document in between the taxpayer as well as the tax authorities.– Plan of a person’s service as well as/ or exclusive affairs in order to lessen tax responsibility.

– Term utilized to represent an unique form of double taxation alleviation in tax treaties with creating nations. Where a country gives tax incentives to motivate international financial investment and that firm is a resident of another nation with which a tax treaty has actually been wrapped up, the other nation might provide a credit versus its very own tax for the tax which the business would certainly have paid if the tax had not been “spared (i.

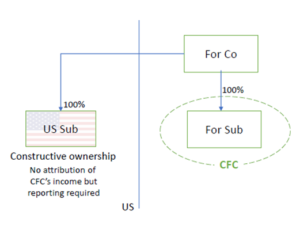

Specified Foreign Corporations & Controlled Foreign … in Salisbury, Maryland

given upProvided” under the provisions of stipulations tax incentivesTax obligation– Degree (of revenue, capital, sales, etc.) at which tax begins to be imposed.

– Term utilized to indicate the principle of levying tax only within the territorial jurisdiction of a sovereign tax authority or nation, which is taken on by some nations. Homeowners are not exhausted on any foreign-source earnings.– A business is claimed to be “thinly capitalised” when its equity capital is little in contrast to its financial debt capital.

g. sales tax, unmovable property transfer tax, and so on– A transfer cost is the price billed by a firm for items, solutions or intangible building to a subsidiary or various other associated business. offshore trusts inheritance tax. Violent transfer prices occurs when income and expenses are improperly allocated for the objective of reducing gross income.

Us Tax Reform And Its Implications For Australia – Eurekahedge in Fredericksburg, Virginia

– Term extensively utilized to describe the succeeding implementation of legislation which problems with prior treaty commitments – offshore trusts inheritance tax. As a basic policy, the arrangements of a tax treaty applied locally dominate other residential regulation. In some countries the relationships is governed by the “last in time” regulation.– An analysis of tax treaty stipulations to structure an international transaction or procedure so as to make the most of a specific tax treaty.

Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

– A depend on is a legal setup whereby the proprietor of residential or commercial property (i. e. settlor) transfers possession to an individual(s) (i. e. trustee) who is to hold as well as control the building according to the proprietor’s directions, for the benefit of an assigned individual or individuals (i. e. the recipients). Legal title to the trust building is vested in the trustee, while equitable title comes from the beneficiaries.

– Volume of service of an enterprise as stated in the profit and loss account. It is normally gauged by recommendation to the gross invoices, or gross quantities due, from the sale of products or solutions, etc. supplied by the entity.– General term made use of to describe the various kinds of usage and sales tax obligations.

2020 Year-end Tax Overview For International Companies in Lafayette, Indiana

Global Tax & Accounting Group – Miami, United States in Gardena, California

Global Tax & Accounting Group – Miami, United States in Gardena, California– See: Thin capitalisation– Tax which is charged on business income out of which rewards are paid, however which does not look like a direct reduction or withholding from the reward itself.– See: Credit report, underlying tax– Annual tax imposed, along with the normal business income tax, on the undistributed part of the revenues or excess of a company.

Unnecessary difficulty is a problem criterion to the granting of an expansion of time to make a tax repayment.– Term used to describe investment income such as dividends, interest and royalties.– Granting of remedy for the results of international dual taxation on the basis of residential legislation rather than the arrangements of a tax treaty.

e. raw land).– Under a unitary tax system, the profits of the various branches of a venture or the numerous corporations of a group are calculated as if the entire team is a unity. A formula is used to assign the take-home pay of the entire group to the various components of the team.

2019 Year-end Tax Letter: International Taxation – Baker Tilly in Midland, Texas

Global Tax & Accounting Group Corp – Better Business Bureau … in Jacksonville, Florida

Global Tax & Accounting Group Corp – Better Business Bureau … in Jacksonville, Floridaare formula aspects.– Responsibility of an investor which encompasses the full degree of his personal properties, as in the situation of a sole owner or general partner.– Returns flowing from a subsidiary company to its parent firm.– Period throughout which it is approximated that a depreciable asset will certainly provide useful solution to business in which it is made use of.

– Teaching which holds that differently located taxpayers ought to be discriminated, i. e. taxpayers with even more revenue and/or capital need to pay more tax.– There are three multilateral “Vienna Conventions” which matter for tax objectives. Among them, the Convention of 23 May 1969 on the Legislation of Treaties is especially associated to the analysis of tax and various other treaties.

Tax– imposed at resource as a withholding on earnings; tax obligations therefore held back are usually balanced out versus final earnings tax obligation (if any). Income tax systems typically enable deductions in computing the revenues of an organization utilizing buildings, plant and machinery which are subject to wear and also tear in the training course of the organization.

Tax Planning Tips For Businesses On Avoiding Unexpected … in Caguas, Puerto Rico

– A lawful file that works as a vital lorry of transfer at death.– The process of selling off a company.– When income or goods are withdrawn from an organization by the entrepreneur to his private house (without a factor to consider), the revenue or the value of such items generally constitutes a taxable event in the hands of the recipient for income tax functions.

– Tax on revenue imposed at source, i. e – offshore trusts inheritance tax. a 3rd party is charged with the task of deducting the tax from certain sort of repayments and also paying that amount to the federal government. Withholding taxes are discovered in practically all tax systems as well as are widely utilized in regard of rewards, passion, nobilities and also similar tax payments.

– The value of an asset which is depreciable for revenue tax objectives, identified by deducting from the overall price, consisting of installment, and so on the reduction that have been made for deterioration or depreciation in previous tax years.– Lasting bond on which interest is not payable often, yet instead upon maturation of the bond.

Irs Provides Very Modest Relief From Downward Attribution … in College Station, Texas

– The term is used in connection with BARREL, where the price of tax which is in principle levied but at a price of 0% to make sure that essentially no tax is payable, but will result in refunds of input tax debts.

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

Becoming a UNITED STATE local is a crucial occasion in the life of any type of international national. For some it represents only a temporary keep in the UNITED STATE, however for lots of others it notes the end of a long process to acquire what is commonly described as a “permit” (a holdover reference to when the cards were really eco-friendly), which represents the owner’s lawful right to stay completely in the United States.

Tags: cross border tax advice, how to file taxes when married to a foreign, us totalization agreements