business shareholder to decrease its tax basis in the stock of a tested loss CFC by the “used-tested loss” for objectives of identifying gain or loss upon disposition of the evaluated loss CFC. Because of significant remarks elevated with regard to this guideline, the final laws reserve on policies connected to basis modifications of examined loss CFCs.

These rules were all previously proposed in the broader foreign tax credit package launched last November. The final regulations: Finalize a proposed rule (without adjustment) that provides that a returns under Area 78 that connects to the taxable year of a foreign company starting prior to Jan. 1, 2018, must not be dealt with as a returns for objectives of Section 245A.

e., election to discard using internet operating losses in establishing the Section 965 amount). Complete proposed regulations under Area 861 (with some adjustments) that clarifies certain policies for adjusting the stock basis in a 10%-possessed corporation, including that the change to basis for E&P includes formerly strained earnings as well as profits.

How The Tax Cuts And Jobs Act Will Impact Outsourcing in Antioch, California

Global Tax in Concord, North Carolina

Global Tax in Concord, North Carolina78-1(a) to Section 78 rewards gotten after Dec. 31, 2017, with regard to a taxed year of an international firm start before Jan. 1, 2018. The Area 965 regulations included in this final regulation apply beginning the last taxable year of an international corporation that starts prior to Jan.

Treasury Assesses Impact Of Federal Tax Reform On Cit … in Gary, Indiana

Under this method, a taxpayer might not omit any kind of thing of revenue from gross evaluated earnings under Section 951A(c)( 2 )(A)(i)(III) unless the revenue would be international base business earnings or insurance policy earnings however for the application of Area 954(b)( 4 ) – foreign derived intangible income.

In action to these comments, the Internal Revenue Service recommended that the GILTI high-tax exemption be broadened to include particular high-taxed revenue even if that revenue would certainly not otherwise be international base company earnings or insurance earnings. Under the suggested regulations, IWTAS.com the GILTI high-tax exemption would certainly be made on an elective basis.

The effective tax price test is 90% of the maximum efficient rate (or 18. 9%), and is determined based on the quantity that would certainly be deemed paid under Section 960 if the thing of income was Subpart F. The efficient price examination would be done at the certified company system level.

How Internationally-based Companies Are Impacted By The … in Bethlehem, Pennsylvania

Simply put, it can not be made precisely, or with respect to specific CFCs. The election looks for existing and also future years unless withdrawed. Although it can be revoked, the political election is subject to a 60-month lock-out duration where the political election can not be re-elected if it has actually been revoked (as well as a comparable 60-month lock-out if it is made once more after the very first 60-month duration).

The proposed GILTI high-tax exclusion can not be trusted till the policies are issued as last. In a lot of cases, the recommended GILTI high-tax exemption might give much needed relief for sure taxpayers. As drafted, the election is not one-size-fits-all – foreign derived intangible income. The political election can produce negative outcomes for particular taxpayers. For example, if a taxpayer has a high-taxed CFC and a low-taxed CFC, the political election would certainly leave out from tested revenue the revenue of the high-taxed CFC, yet not the earnings of the low-taxed CFC.

tax. The recommended laws would apply an accumulated technique to domestic collaborations. Specifically, the recommended guidelines provide that, for objectives of Sections 951, 951A and also any type of stipulation that uses by recommendation to Areas 951 and also 951A, a domestic partnership is not dealt with as possessing stock of a foreign corporation within the meaning of Section 958(a).

A Deep Dive Into The Gilti Taxing Regime And Cfc Gilti Tax … in Dublin, California

This regulation does not use, however, for functions of determining whether any U.S. person is an U.S. investor, whether a UNITED STATE shareholder is a managing residential shareholder, as specified in Treas. Reg. Sec. 1. 964-1(c)( 5 ), or whether a foreign company is a CFC. Comparable to the guideline defined over in the final laws, a residential partnership that has an international firm is treated as an entity for functions of figuring out whether the partnership as well as its companions are UNITED STATE

Nonetheless, the partnership is dealt with as an aggregate of its companions for objectives of establishing whether (as well as to what level) its partners have inclusions under Sections 951 and 951A and also for objectives of any type of other stipulation that applies by referral to Sections 951 as well as 951A. This aggregate therapy does not get any type of various other functions of the Code, consisting of Section 1248.

3 Gilti Planning Options Non-c Corporations Should … in Doral, Florida

The policies contain an example highlighting this point. In the instance, an U.S. private has 5% and a domestic company possesses 95% in a residential partnership that consequently that has 100% of a CFC. Since the individual indirectly has less than 10% in the CFC, the person is not a United States investor and also thus does not have an income incorporations under Section 951 or a professional rata share of any type of quantity for functions of Area 951A.

The modifications associated to the GILTI high-tax exclusion election are proposed to relate to taxable years of foreign corporations starting on or after the date that last laws are published, as well as to taxed years of UNITED STATE shareholders in which or with which such taxable years of international corporations end. Because of this, the policies would not be reliable until a minimum of 2020 for calendar-year taxpayers.

individual in which or with which such taxed years of international firms end. Nonetheless, a residential collaboration might count on the policies for tax years of a foreign firm start after Dec. 31, 2017, and for tax years of a residential collaboration in which or with which such tax years of the international firm end (topic to a related event uniformity regulation).

Own A Cfc? Get Ready To Be Gilti… – Ryan & Wetmore, P.c. in Beaverton, Oregon

Most of the final rules apply retroactively to 2018. Certainly, this means numerous taxpayers have to currently review and change any kind of finished GILTI estimations, as well as consider the last guidelines when preparing 2018 income tax return. Further, taxpayers who have actually already submitted 2018 tax returns with GILTI inclusions need to consider whether amended returns ought to be submitted.

Absolutely nothing here will be understood as imposing a restriction on anyone from disclosing the tax treatment or tax structure of any kind of matter addressed herein. To the degree this web content might be thought about to have written tax guidance, any kind of written recommendations consisted of in, sent with or connected to this material is not intended by Grant Thornton LLP to be utilized, as well as can not be made use of, by any kind of person for the purpose of preventing penalties that may be enforced under the Internal Profits Code.

It is not, and also should not be understood as, accountancy, legal or tax suggestions given by Give Thornton LLP to the viewers. This material might not be appropriate to, or suitable for, the viewers’s certain conditions or needs and also might need factor to consider of tax and nontax variables not explained herein.

“The Tax Cuts And Jobs Act” in Round Rock, Texas

Modifications in tax regulations or various other elements could influence, on a potential or retroactive basis, the information included here; Grant Thornton LLP thinks no responsibility to inform the viewers of any kind of such modifications. All recommendations to “Section,” “Sec.,” or “” describe the Internal Income Code of 1986, as modified.

tax under the prior tax routine. And because the GILTI stipulations relate to all U.S. shareholders of CFCs, they stand to have a widespread impact. Below are some choices and factors to consider taxpayers with CFCs must talk about with their advisors to reduce the influence of the GILTI arrangements. To fully comprehend preparing options for non-C Firms, it’s handy to recognize how GILTI operates for C Corporations.

Global Tax & Business Services – Greater Sumter Chamber Of … in Hampton, Virginia

Global Tax & Business Services – Greater Sumter Chamber Of … in Hampton, VirginiaThe advantage of this election is that it allows the specific to assert a foreign tax credit for taxes paid on the GILTI amount. It is important to note this earnings will certainly be subject to a second degree of U.S. tax when distributed out of the U.S.

owner and eligible for the foreign tax credit. Planning for GILTI for the 2018 tax year and beyond can make a big influence on your tax situation, particularly if you are not a C Corporation.

How Big Companies Won New Tax Breaks From The Trump … in Huntington, West Virginia

Details included in this message is considered exact as of the date of publishing. Any kind of action taken based on details in this blog site need to be taken just after an in-depth review of the details facts, conditions and existing law.

Jennifer is a Tax Manager for Wilke & Associates CPAs & Service. Jenn is not your day-to-day tax pro. She is an experienced audit as well as tax expert with direct experience in all areas of the annual report, revenue declaration, income tax preparation, and organization consulting.

And also it seeks to guarantee that they pay at the very least a certain degree of tax on all incomes. In this new age of taxation, lots of global companies are impacted by the GILTI tax.

Us Taxes Abroad For Dummies (Update For Tax Year 2020) in Des Plaines, Illinois

Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

Our planning scenarios take into consideration the lasting goals as well as objectives of the international firm prior to implementing GILTI tax planning scenarios. Often Asked Questions regarding the GILTI Tax Our GILTI Preparation Process Our GILTI planning process consists of 6 steps: Things have actually changed!

Often, little changes can dramatically decrease your tax obligations. Big or little, these adjustments have to straighten with other company goals and also constraints. We determine the kinds of modifications that could make good sense for your service as well as possibly give substantial continuous tax financial savings. The outcome of this action is a listing of situations that reflect the small or major adjustments that you are thinking about making in your business.

This step reveals the projected tax impacts of the combined elements special to your organization. Based upon the results of Step 3, we suggest a way ahead. As well as we help you recognize the pros, cons, and also ramifications of the recommended modifications. Once a primary strategy is recognized, you might have more concerns concerning the effect of certain minor adjustments.

Tax Take: Oecd Is Gilti As Charged? – Miller & Chevalier in Carson City, Nevada

The result is a composed GILTI strategy, which outlines the last referrals. When the GILTI strategy remains in position on the United States side, it is essential to examine that it will not produce any type of tax surprises in other countries. We suggest that you take this last action with your international tax advisors.

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

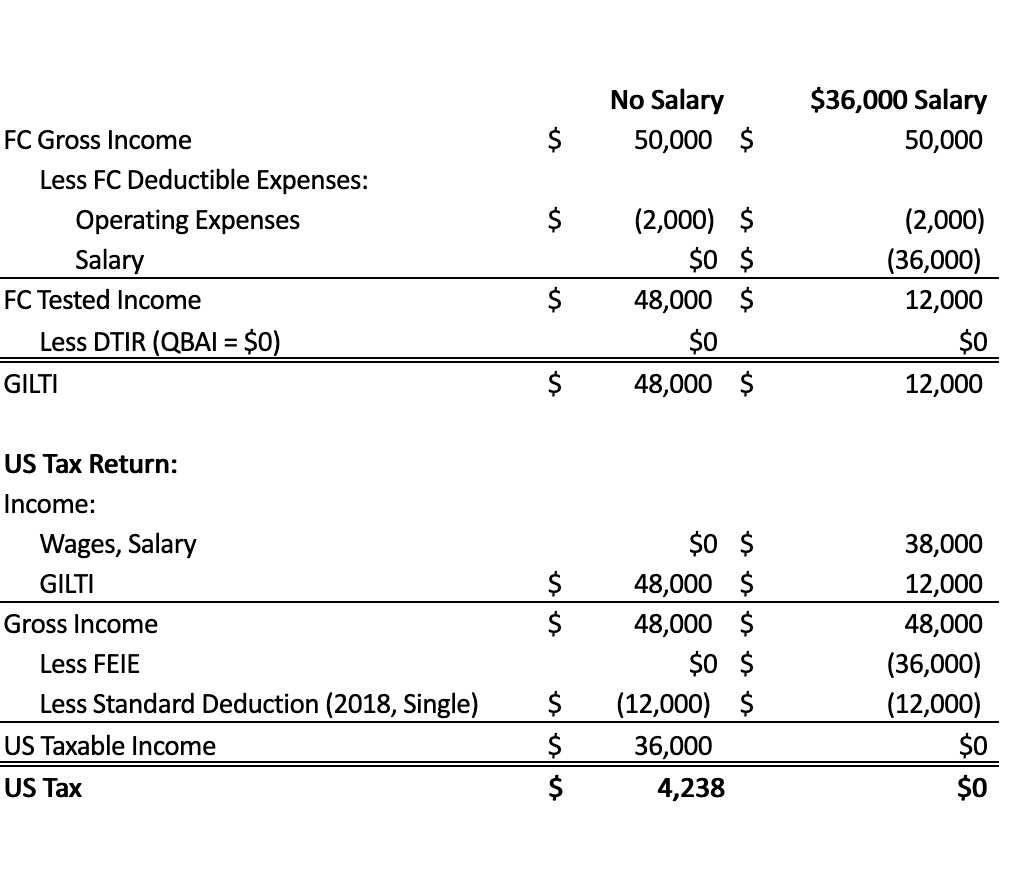

We can also coordinate straight with them to ensure that the final GILTI plan minimizes your tax on a worldwide scale. Client Tale of GILTI Tax Planning in Action The proprietor of an IT business in the Center East called us since he simply came to be an US resident during the year and also wanted to know just how to lessen the US taxes relevant to his company.

Tags: fbar maximum account value, gilti tax, international tax attorney