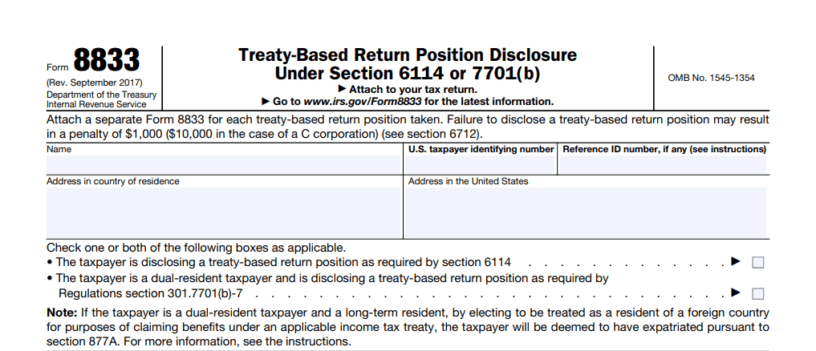

Generally terms, tax treaties offer that if branch operations in a foreign country have enough compound and also connection, the nation where those activities take place will certainly have primary (but not special) jurisdiction to tax. In various other instances, where the procedures in the foreign country are fairly small, the home nation preserves the single jurisdiction to tax.

Tax treaties protect taxpayers from possible double taxation mainly via the allocation of exhausting rights between both countries – international tax accountant. This allocation takes numerous types. Since home is relevant to territory to tax, a treaty has a mechanism for dealing with the concern of house in the instance of a taxpayer that or else would be considered to be a local of both countries.

Third, a treaty provides regulations for determining the country of source for every classification of revenue. Fourth, a treaty develops the commitment of the home country to remove dual tax that otherwise would certainly occur from the workout of simultaneous difficult territory by the 2 countries. A treaty offers for resolution of disputes between jurisdictions in a way that prevents double tax.

International Benefits Compliance Alert – Woodruff Sawyer in Brunswick, Georgia

Under U.S. law, settlements to non-U.S. persons of rewards and aristocracies in addition to specific settlements of interest undergo holding back tax equivalent to 30 percent of the gross quantity paid. A lot of our trading partners impose similar degrees of withholding tax on these sorts of earnings. This tax is troubled a gross, as opposed to internet, amount.

Tax treaties alleviate this burden by setting maximum degrees for the keeping tax that the treaty partners might impose on these types of revenue or by attending to unique residence-country tax of such earnings with the elimination of source-country withholding tax. As an enhance to these substantive guidelines relating to allocation of straining rights, tax treaties provide a device for dealing with disagreements in between nations pertaining to the appropriate application of a treaty.

Under numerous such contracts, the experienced authorities concur to allocate a taxpayer’s revenue between the 2 taxing territories on a consistent basis, thereby preventing the double taxes that could otherwise result. The U.S. competent authority under our tax treaties is the Assistant of the Treasury or his delegate. The Secretary of the Treasury has delegated this feature to the Replacement Commissioner (International) of the Huge Organization as well as International Department of the Irs.

I Am Self-employed Living Overseas. Can I Use Turbotax To File … in Colton, California

This is comparable to a standard investor defense provided in other kinds of arrangements, however the nondiscrimination stipulations of tax treaties are specifically tailored to tax matters and also, consequently, are the most reliable methods of dealing with possible discrimination in the tax context – international tax accountant. The relevant tax treaty arrangements explicitly prohibit sorts of discriminatory measures that once were usual in some tax systems, and also clarify the fashion in which possible discrimination is to be evaluated in the tax context.

tax treaties is the arrangement dealing with the exchange of information in between the tax authorities. Under tax treaties, the competent authority of one nation might ask for from the various other skilled authority such details as may be relevant for the proper management of the very first country’s tax laws (the details given according to the demand undergoes the strict discretion defenses that use to taxpayer details).

tax laws, information exchange is a priority for the United States in its tax treaty program. If a country has bank privacy policies that would certainly run to protect against or seriously inhibit the suitable exchange of details under a tax treaty, we will certainly not enter right into a brand-new tax treaty connection with that nation.

Fatca-agreement-curacao-12-16-2014.pdf – Treasury in Rochester, New York

In establishing our working out top priorities, our main objective is the verdict of tax treaties that will certainly give the greatest benefit to the United States and also to U.S

A treaty arrangement need to take right into account all of these facets of the specific treaty partner’s tax system and treaty policies to show up at an agreement that completes the United States tax treaty purposes.

What Us Expats Need To Know About Totalization Agreements in Norwalk, California

Possible treaty partners need to proof a clear understanding of what their commitments would be under the treaty, specifically those with respect to info exchange, and should demonstrate that they would certainly be able to satisfy those responsibilities. Often a tax treaty may not be suitable due to the fact that a potential treaty companion is not able to do so.

If the potential treaty partner is reluctant to provide meaningful benefits in a tax treaty, investors would find no relief, and also accordingly there would certainly be no value to entering into such an agreement. The Treasury Department would not negotiate a tax treaty that did not supply purposeful advantages to UNITED STATE

Self-employment Tax For Businesses Abroad – Internal … in Springfield, Ohio

Sometimes an often treaty prospective insists companion provisions to stipulations the United States will not agree, concur as providing an U.S. tax credit tax obligation credit scores in financial investment foreign country (nation “tax sparingTax obligation).

individuals pay much less tax to that nation on revenue from their investments there as well as homeowners of that country pay less UNITED STATE tax on earnings from their financial investments in the United States. Those decreases and advantages are not meant to move to citizens of a 3rd nation. If third-country residents have the ability to exploit one of our tax treaties to protect decreases in UNITED STATE

possessions, the advantages would certainly flow just in one direction, as third-country homeowners would certainly enjoy UNITED STATE tax reductions for their UNITED STATE financial investments, yet U.S. citizens would not take pleasure in mutual tax decreases for their financial investments because 3rd nation. In addition, such third-country locals might be safeguarding benefits that are not ideal in the context of the interaction in between their residence country’s tax systems as well as plans and those of the United States.

Preventing this exploitation of our tax treaties is important to ensuring that the third country will take a seat at the table with us to work out on a reciprocal basis, so we can secure for UNITED STATE persons the advantages of decreases in resource- country tax on their investments in that country – international tax accountant.

tax treaty are not appreciated by homeowners of nations with which the United States does not have a bilateral tax treaty since that nation enforces little or no tax, as well as therefore the potential of unmitigated dual taxation is reduced. In this regard, the recommended tax treaty with Hungary that is before the board today includes a thorough restriction on benefits arrangement and stands for a significant progression in shielding the UNITED STATE

Tax Information – University Of Houston in Madison, Alabama

As was reviewed in the Treasury Division’s 2007 Report to the Congress on Earnings Stripping, Transfer Prices and also UNITED STATE Earnings Tax Treaties, the existing revenue tax treaty with Hungary, which was authorized in 1979, is among three UNITED STATE tax treaties that, as of 2007, offered an exemption from source-country withholding on rate of interest payments, however had no securities versus treaty buying.

A vital element of UNITED STATE income tax treaties is to give for the exchange of information between tax authorities where the financial partnership between two nations is such that an earnings tax treaty is ideal. Where an income tax treaty is not appropriate, details exchange can be protected with a tax information exchange arrangement (a “TIEA”) which has provisions solely on sharing of tax information.

Under our tax treaties, when an U.S. taxpayer ends up being worried regarding application of the treaty, the taxpayer can bring the matter to the U.S. proficient authority that will certainly look for to solve the issue with the qualified authority of the treaty companion. The qualified authorities are anticipated to function en masse to deal with authentic conflicts as to the appropriate application of the treaty.

International Tax Blog – Sciarabba Walker & Co., Llp- Part 4 in Bolingbrook, Illinois

Global Taxes, Llc: New York, Ny Accounting Firm – Mobile ... in Towson, Maryland

Global Taxes, Llc: New York, Ny Accounting Firm – Mobile ... in Towson, Marylandcompetent authority has a good track record in fixing disputes. Also in the most cooperative bilateral partnerships, nevertheless, there may be circumstances in which the skilled authorities will not have the ability to get to a prompt as well as satisfying resolution. As the number and intricacy of cross-border transactions boosts, so do the number and also complexity of cross-border tax conflicts.

Over the past few years, we have meticulously thought about as well as examined various sorts of required mediation procedures that could be consisted of in our treaties and also used as component of the qualified authority common arrangement process. Specifically, we analyzed the experience of countries that adopted required binding settlement stipulations relative to tax issues.

Based on our evaluation of the U.S. experience with mediation in other locations of the law, the success of other countries with mediation in the tax area, and also the frustrating support of the business area, we ended that obligatory binding settlement as the final step in the competent authority process can be an efficient as well as proper device to help with common agreement under U.S

Learn About Taxes While Working Abroad – Columbia Finance in Pico Rivera, California

Among the treaties prior to the committee, the suggested method with Switzerland, consists of a type of compulsory settlement arrangement that as a whole terms is similar to settlement provisions in several of our current treaties (Canada, Germany, Belgium as well as France) that have been accepted by the board and also the Senate over the last 5 years.

taxpayer presents its instance to the U.S. qualified authority as well as takes part in creating the setting the U.S. competent authority will certainly take in conversations with the treaty companion. Under the adjudication arrangement recommended in the Switzerland procedure, as in the comparable provisions that are now part of our treaties with Canada, Germany, Belgium, as well as France, if the experienced authorities can not solve the issue within 2 years, the proficient authorities must offer the concern to a mediation board for resolution, unless both qualified authorities concur that the instance is not ideal for adjudication.

That position is adopted as the agreement of the experienced authorities as well as is dealt with like any type of various other shared arrangement (i. e., one that has been worked out by the skilled authorities) under the treaty. The arbitration procedure suggested in the agreement with Switzerland is mandatory and binding with regard to the qualified authorities.

Content Solutions – Ibfd in Denver, Colorado

The taxpayer keeps the right to litigate the issue (in the United States or the treaty companion) in lieu of accepting the outcome of the adjudication, just as it would certainly be qualified to litigate in lieu of accepting the result of an arrangement under the mutual arrangement treatment. The adjudication guideline in the suggested method with Switzerland is very comparable to the arbitration rule in the procedure with France, however differs a little from the adjudication regulations in the agreements with Canada, Germany, and also Belgium.

We are enthusiastic that our wanted purposes for mediation are being realized. Our sense is that, where required mediation has been consisted of in the treaty, the skilled authorities are discussing with more purpose to reach principled and also prompt resolution of disagreements, and hence, properly eliminating double taxes and also in a more expeditious manner.

Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, Fatca Crs Status, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

We intend to remain to examine various other adjudication arrangements and to check the efficiency of the arrangements in the contracts with Canada, Belgium, Germany, and France, in addition to the performance of the stipulation in the contract with Switzerland, if ratified. The Irs has released the administrative treatments required to carry out the mediation rules with Germany, Belgium, and also Canada.

United-states – Pensions And Benefits – Canada.ca in Corpus Christi, Texas

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

The three treaties are normally regular with modern U.S.For this reason, as stated above, entering into a revised Convention has been a top tax treaty priority for the Treasury Factor. The brand-new Limitation on Advantages write-up includes a stipulation approving so-called “acquired benefits” similar to the arrangement included in all recent UNITED STATE tax treaties with nations that are participants of the European Union.