The deal rate of a contract is not needed to be fixed or determinable to acknowledge profits under the new requirement. This modification might cause timing distinctions between publication and also tax because profits may be acknowledged for book objectives prior to it is fixed, determinable and also acknowledged for tax functions.

The brand-new earnings recognition criterion will certainly additionally have ramifications for the accounting for revenue taxes. For some companies, modifications in taxable momentary distinctions occurring from the application of the brand-new criterion might also have results on the analysis of an evaluation allowance.

Added advice from IRS will certainly be necessary to attend to incongruities in between the brand-new requirement and the tax rules, and also to enhance the process of executing adjustments from a tax viewpoint. The Treasury Department and Internal Revenue Service have asked for public discuss these problems, yet no guidance has actually been issued thus much.

The FASB makes up seven full time board members that are assigned by the FAF Board of Trustees. Participants might dish out to two five-year terms. A professional personnel of greater than 60 individuals supports the FASB. Board members and team are concentrated on the demands of capitalists, various other capital markets individuals, and also the public passion when it pertains to monetary accounting and coverage.

What You Need To Know About Revenue Recognition – Fasb in Philadelphia, Pennsylvania

The Boards are anticipated to issue a final requirement in 2013. Leases Leases are a vital resource of financing for several companies that rent properties.

Financial Instruments The goal of the joint project on accountancy for economic tools is to supply economic statement individuals with an extra timely as well as representative representation of a firm, establishment, or not-for-profit company’s participation in financial instruments, while decreasing the complexity in bookkeeping for those tools. The Boards are conducting this task in three stages, and also both have provided recommended criteria on the first two stages: bookkeeping for credit score losses as well as recognition and dimension of economic instruments (who needs to file fbar).

Following the final thought of the comment period on credit losses, the Boards will certainly figure out whether there prevails ground in creating a converged criterion. On the problem of category and measurement, the Boards are converged on the significant decisions, as well as anticipate to deliberate during the second fifty percent of 2013. The third phase of the accounting for economic instruments job takes a look at hedging.

Developed in late 2010, the Not-for-Profit Advisory Committee (NAC) sent its recommendations to the FASB on just how to revitalize the present not-for-profit coverage version. While NAC members reveal satisfaction with the existing design, they supplied a number of suggestions for enhancing the info not-for-profit financial declarations offer to donors as well as other users.

Revenue Recognition – Gaap Vs. Ifrs – Schneider Downs in San Marcos, California

The standard-setting job seeks to enhance the present web property classification plan and also info offered in financial statements and notes about an organization’s liquidity, financial efficiency, and capital. The study task will certainly study various other means of interaction that not-for-profit companies currently make use of in telling their financial tale – who needs to file fbar. For 40 years, the FASB has embarked on these and lots of other projects with one objective in mind: the regular improvement of audit standards to offer decision-useful details to investors and also various other individuals of monetary reports.

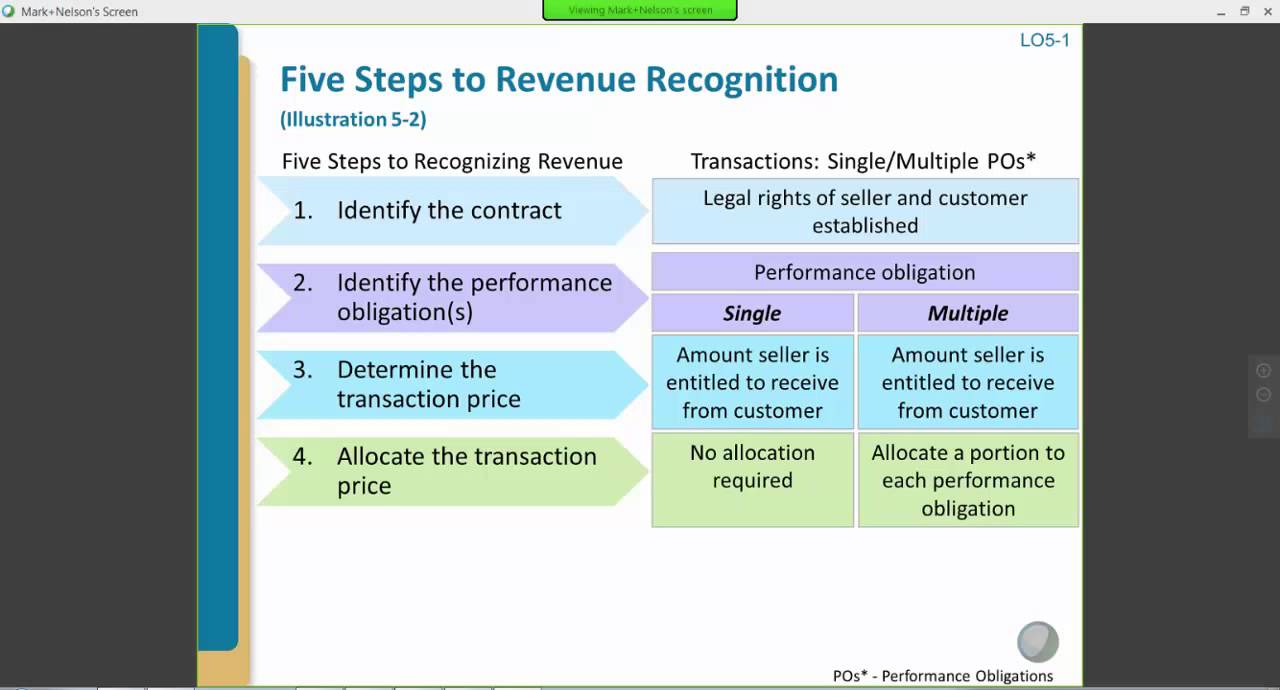

, I offered an overview of the five-step procedure for identifying income. Below I’ll concentrate on the fifth step, which is exactly how to figure out when revenue needs to be recognized.

ASC 606 sets out three standards for identifying whether income must be recognized gradually. If the contract meets any among these three, then earnings ought to be recognized with time. The customer gets as well as uses the benefits of the service at the same time that the business does the service.

Control of the property or possessions being created passes to the client as the organization does. An example of this is an industrial storage facility being created ashore owned by the consumer. The product or the service has no alternative usage apart from its use by the customer, as well as there is an enforceable right to payment for work completed to day.

Similarities And Differences – Pwc Uk Blogs in Hattiesburg, Mississippi

If none of these standards apply, revenue is acknowledged at a point. The complying with events can be utilized as a sign to establish the ideal point: The company has a present right to settlement for the goods or services. The consumer has legal title. The company has actually transferred physical belongings of the asset.

When earnings is identified gradually, business needs to pick a method to measure development in finishing the contract, and this technique requires to be used regularly for comparable contracts. The concept is to identify revenue in proportion to the products as well as solutions moved to the customer so much.

An outcome method checks out the reasonable market value of items and also solutions transferred to the consumer to day. An input method will be based upon the costs for labor as well as products as business incurs them. A substantial change from tradition GAAP is the approach to be utilized in construction agreements that consist of installment of large parts that are created by 3rd events.

An instance in the standards is the installation of an elevator for an overall contract price of $5 million. In this instance, the approximated price for the whole agreement is $4 million, of which $1. 5 million is the expense of the elevator itself. If the lift is supplied at a point when only 20% ($500,000) of the added expenses have been incurred, after that including the lift’s expense in the total would overemphasize progression towards completion of the job.

Revenue Recognition Standards Are Changing. Here’s What … in Lauderhill, Florida

5 million), plus 20% of the staying profits (20% x $3. Under percent of completion, the entity would certainly have incurred 50% of the total prices and so would certainly identify 50% of the earnings, or $2. This brand-new requirement has been called the most significant change in audit since Sarbanes-Oxley.

In this guide, we’ll cover what income acknowledgment is, exactly how the rules around it have altered just recently, and how to make sure you’re doing it right. Earnings recognition is finding out when an organization has really made its earnings. If your business utilizes the cash basis of accountancy, that’s simple: you earn your profits when the cash hits your sales register or financial institution account.

Think of this revenue recognition system as the statistics version of GAAP; while the USA utilizes GAAP, most of the remainder of the world makes use of IFRS. It’s administered by the International Accountancy Requirement Board (IASB). who needs to file fbar.

Unless you’re running beyond the United States, you don’t require to bother with the IFRS revenue acknowledgment requirement. If you increase past the borders of the States, however, you need to talk with certified accounting professional regarding adhering to IFRS. Individuals outside your business, like capitalists, will certainly frequently require that your economic declarations abide by GAAP or IFRS.

Asc 606 – Revenue From Contracts With Customers – Dhg in Lynn, Massachusetts

Global Tax & Accounting 7112 Darlington Dr, Parkville, Md … in Flower Mound, Texas

Global Tax & Accounting 7112 Darlington Dr, Parkville, Md … in Flower Mound, TexasRevenue that you’ve collected however not acknowledged is called (or “unearned profits”). Despite the fact that it has the word “earnings” in the name, accounting professionals categorize deferred earnings as a responsibility, due to the fact that it is practically money you owe your clients. When the a glass of wine store from the example over collects $600 at the start of the year from a customer, the store would originally have to tape-record all $600 as delayed income.

It’s indicated to improve comparability in between monetary declarations of companies that release GAAP economic statementsso, in concept, capitalists can line up income declarations as well as balance sheets from various businesses, and also see how they do relative to one another.

If you do not have an exact price for each good or solution, approximate it. See to it to acknowledge revenue just after you have actually supplied each good or solution you seperated and valued out in actions 1-4. One market that will certainly be drastically impacted by ASC 606 is the software program as a solution market (Saa, S), primarily due to the fact that of how inconsistent as well as unclear Saa, S accounting made use of to be prior to the changes.

Saa, S business aren’t the only services that will certainly be influenced by ASC 606. If you run a service that collects payments from consumers up-front and your capitalists or loan providers want your economic records to be in line with GAAP, it pays to read up on ASC 606.

Generally Accepted Accounting Principles (Gaap) – Cliffs Notes in Huntington, West Virginia

If you’re a start-up looking for financial investment, a mama and also pop looking for a bank funding, or you’re looking to offer your business, the method you tape income needs to be in accordance with GAAP and also ASC 606. Check out over steps 1-5 of ASC 606 above and make certain you understand exactly how they influence the method you acknowledge revenue.

United States GAAP The Audit Standards Codification (ASC) is created and also kept by the FASB. The ASC is the only source of reliable GAAP in the US (apart from SEC released guidelines as well as guidelines that just put on SEC registrants). Some features on this web page web link to accredited products and also are only readily available to logged-in members as well as pupils.

Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

A four quantity published set of the Accounting Requirements Codification is additionally readily available to seek advice from in the library collection.

Articles as well as books in the Library collection Selected titles A 4 quantity collection of the FASB Codification published by the Financial Audit Criteria Board. The 2015-16 version includes every one of the product released in the Audit Criteria Codification since 31 October 2015 and also is intended to be made use of as a referral device along with the on the internet codification.

Grants Contracts Asc 606 – Exchange Transaction – Barnes … in Taylor, Michigan

Heritage criteria The FASB Bookkeeping Criteria Codification was introduced in July 2009 and also it superseded all pre-existing non-Securities and Exchange Commission (SEC) audit criteria. See our pages on the tradition requirements for info on the material we hold: Can’t discover what you are seeking? If you’re having trouble finding the information you need, ask the Library & Details Solution.

com. ICAEW approves no duty for the web content on any site to which a hypertext link from this website exists. The web links are supplied ‘as is’ with no guarantee, express or implied, for the information offered within them. Please see the full copyright as well as please note notice.

Manager- Finance – Global Tax Accounting – R-40977 in La Mesa, California

Manager- Finance – Global Tax Accounting – R-40977 in La Mesa, CaliforniaInternational Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

According to the FASB, the core concept of the new standard is for firms to identify profits “to depict the transfer of goods or solutions to customers in quantities that reflect the consideration (that is, payment) to which the firm anticipates to be entitled for those good or solutions.” The brand-new standard is anticipated to have some impact on profits acknowledgment for all business.