United States tax declare expats All Americans are required to file a government return if they gain over about $12,000 ($12,400 in 2020, $20,550 in 2021, or simply $400 of self-employment income), any place on the planet they live, and also despite tax treaties or whether they owe any tax to the IRS or if they are paying tax in another nation.

Since of FATCA, this is no longer the situation. If you have any kind of questions or inquiries concerning filing US taxes from abroad, look for guidance from a United States expat tax specialist.

The Foreign Account Tax Compliance Act (FATCA), gone by Congress in 2010 as component of the HIRE Act, is a method of stemming tax evasion with the usage of Foreign Financial Institutions (FFIs). Different to FBAR, its goal is to enforce a withholding on certain assets hung on foreign soil by residents as well as companies based in the United States.

FATCA is a one-size-fits-all strategy to stopping tax evasion with a few exemptions, even U.S. residents who do not invest any time Stateside are subject to FATCA. It’s essential to understand FATCA coverage, what is involved in the procedure as well as what constitutes being excluded from FATCA coverage.

Fatca – Flott & Co. Pc – 703-525-5110 in Richmond, Virginia

residents with FFIs, no matter whether they are held inside or outside of the United States itself. FFIs are needed to report all details concerning economic accounts as well as foreign entities in which UNITED STATE taxpayers hold a substantial passion straight to the Internal Revenue Service. In this capacity, FATCA enforces on all impacted organizations considerable responsibilities to screen and also determine, do due persistance on and process purchases.

federal government proceeds to be worried concerning “profit-shifting” task, excited to seek it out, prosecute the organizations as well as individuals that take part in it, and also collect what it is owed. FFIs that are located to have been escaping FATCA might undergo a corrective tax of up to 30% on all U.S

The listed below FATCA reporting needs checklist describes every little thing to take into consideration and also consist of. Identify whether you need to submit FATCA records at all. For individuals as well as service entities (non-FIFA), establish whether you are needed to file an U.S. federal earnings tax return, then proceed on to the following action. Otherwise, then you do not need to report to FATCA.

Fatca And Non-us Trusts: An Overview – Day Pitney … in Camden, New Jersey

As soon as the bar for reporting is surpassed, reporting is compulsory. Individuals filing with any kind of standing various other than a married, joint filing have a reporting limit of $50,000 if they stay in the United States as well as a reporting threshold of $200,000 if staying outside of the U – what is a foreign trust.S. If filing jointly when wed, the thresholds double, meaning $100,000 in defined foreign properties for U.S

Your tax house is the city or nation in which you do many of your work, defined as “the location where you are permanently or indefinitely engaged to function as a worker or freelance individual.” Essentially, there are many subtleties of FATCA withholding, and also it is best to get in touch with a tax expert to identify where your exception standing exists.

What Is Fatca, What Are Its Impacts & How We Aim To Reform … in Clarksville, Tennessee

counterparty. Defined foreign monetary properties also do not consist of valuable interests in a foreign trust or estate if the person does not understand the interest, and also passion in a social safety and security or comparable program carried out by a foreign government. Timing establishes whether your possessions are subject to FATCA withholding.

account holders to the Internal Revenue Service. This is the various other side of the coin; it makes reporting complicated for establishments that might have those from a multiplicity of citizenships as account holders. Along with coverage demands, the institutions must keep and also pay 30% of any U.S. source revenue and gross profits of safety and securities sales that produce UNITED STATE

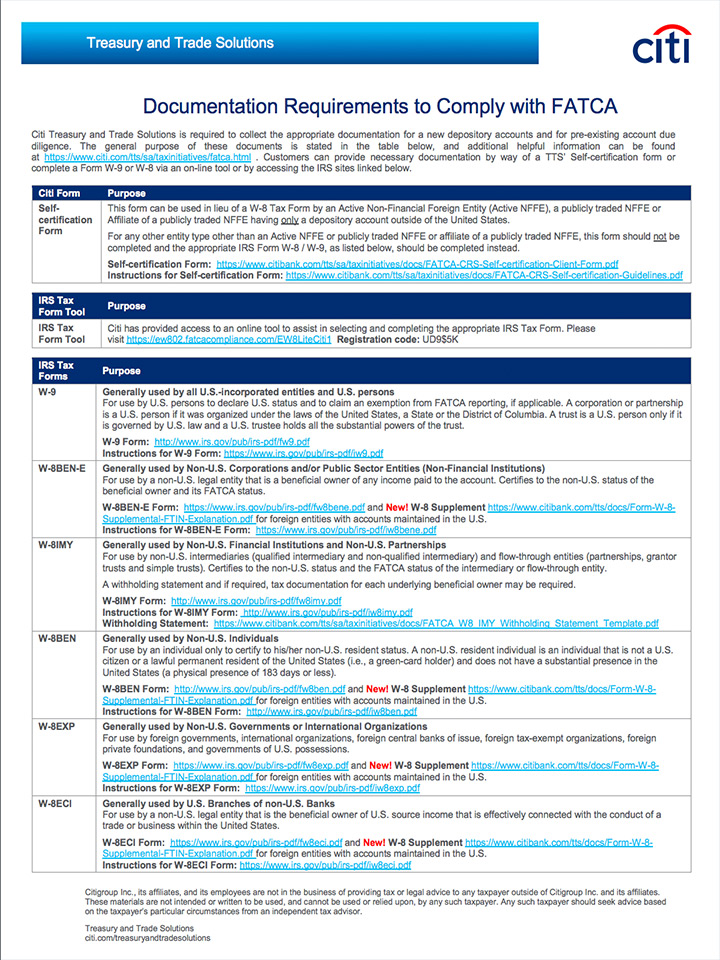

In addition to Kind W-9, types in the W-8 series might apply. Accumulating tax documentation upfront is less complicated than attempting to acquire it in the middle of tax coverage period. On top of that, requiring providers and also entities to make sure that every one of their documentation is up to day on a recurring basis is crucial.

United States And Brazil Sign Fatca Intergovernmental … in El Monte, California

Global Tax & Accounting Group – Instagram in Texas City, Texas

Global Tax & Accounting Group – Instagram in Texas City, TexasCoverage on specific UNITED STATE source earnings paid to non-U.S. persons: From the compliance viewpoint, FATCA reporting is critical. Tax paperwork as well as withholding must be done appropriately so that exact and prompt reporting can occur. In entities with several subsidiaries, especially those with foreign subsidiaries, consumers and also vendors, FATCA compliance must happen year-round to make certain that coverage is right.

When the basic data database as well as methods of management remain in place, organizations can turn toward continuous compliance by implementing studies that can be run occasionally over every one of the different entities that compose an international, multi-level company. These studies can be gotten used to the details requirements of FACTA reporting as it is interpreted by the Internal Revenue Service on an ongoing basis, as well as what’s more, they can be automated for performance and eliminating human error from the formula.

Going along with the letter will certainly be an IRS W-8 BEN as well as W-9 forms. The foreign banks will after that call for the United States individual to accredit under charge of perjury whether they are an US person or not. If it ends up they are either a United States Resident, Legal Permanent Local, Migrant, and/or Accidental Americans the financial institution might send out the account owner information to the Internal Revenue Service.

Biden’s Global Tax Plan Is Not Without Its Challenges - Financial ... in Gaithersburg, Maryland

Biden’s Global Tax Plan Is Not Without Its Challenges - Financial ... in Gaithersburg, MarylandRather, if the bank believes that the client goes to all perhaps a United States person, they may merely send the account owner details to the IRS without giving the consumer any kind of notice. When an U.S. account owner does not follow the foreign bank or other foreign financial organization, 2 common points will certainly happen: Many foreign banks simply do not wish to take care of the headache of having to remain in FATCA compliance.

Fatca Registration And Reporting – Ird in Hinesville, Georgia

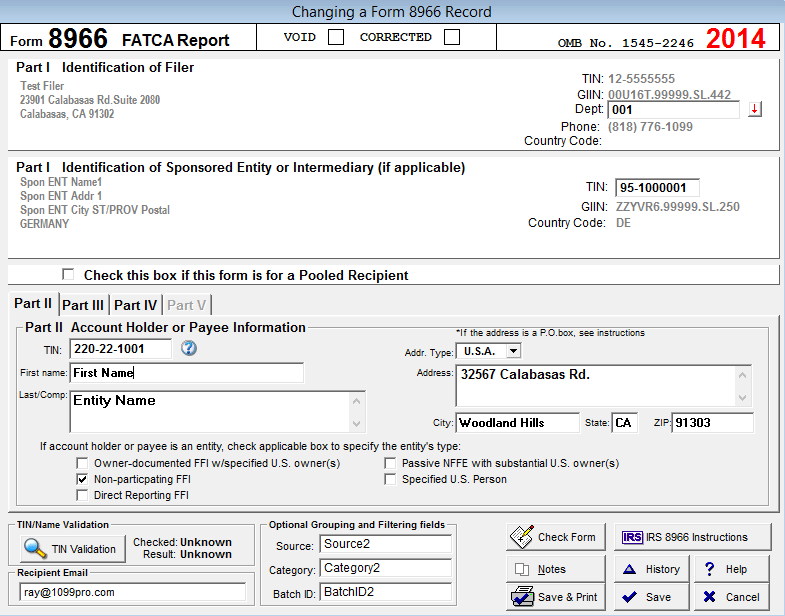

The kind is required to divulge specified foreign monetary assets. This form is a bit different than some other tax forms, because it is a component of your income tax return. For instance, industrial software application for customers such as Turbo, Tax generally does not consist of International info reporting types as component of their type base however they do consist of type 8938.

With lots of other global reporting kinds such as the FBAR, it is required to be submitted even if an income tax return is not needed yet this is not real of the kind 8938. There are various FATCA limit requirements depending on the filing condition of the taxpayers, as well as if they live in the UNITED STATE

If you are wed as well as you as well as your partner submit a joint revenue tax return, you please the reporting limit only if the overall worth of your defined foreign monetary properties is greater than $100,000 on the last day of the tax year or more than $150,000 any time during the tax year.

If you are married and also submit a separate tax return from your spouse, you please the reporting threshold just if the overall value of your specified foreign financial assets is even more than $50,000 on the last day of the tax year or more than $75,000 at any kind of time throughout the tax year – what is a foreign trust.

Frequently Asked Questions (Faqs) Fatca And Crs … in Valdosta, Georgia

If you are not wed, you please the reporting threshold just if the complete value of your defined foreign economic possessions is more than $200,000 on the last day of the tax year or more than $300,000 at any moment during the tax year. If you are wed as well as you as well as your partner file a joint tax return, you satisfy the reporting limit just if the overall worth of your defined foreign monetary possessions is greater than $400,000 on the last day of the tax year or greater than $600,000 at any moment throughout the tax year.

An U.S. person that has been a bona fide local of a foreign nation or nations for an undisturbed period that consists of an entire tax year. An U.S. person or resident who is existing in a foreign country or countries a minimum of 330 complete days during any type of duration of 12 successive months that ends in the tax year being reported.

There are numerous assets that the IRS calls for Taxpayers to include when applying for FATCA conformity. Several of the more usual assets, include: Direct Supply as well as Stocks Stock Accounts Financial Institution Accounts Investment Accounts Life Insurance Coverage Foreign Pension plan Some possessions require more detailed reporting than others. When the possession is reported as a deposit or custodial account, the coverage is normally less complex than a straight property, such as a stock certification.

Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

If an individual has interest revenue, they will determine it on the initial web page of the Type 8938, consisting of the form and timetable along with the line number. If you are needed to file Kind 8938 but do not submit a complete as well as right Form 8938 by the due day (including extensions), you may be subject to a fine of $10,000.

Fbar Vs Fatca: What You Need To Know in Hemet, California

The maximum additional penalty for a continuing failing to submit Form 8938 is $50,000. If you are wed and also you and also your spouse file a joint earnings tax return, the failing to file charges use as if you and also your spouse were a bachelor. You and your partner’s responsibility for all charges is joint as well as numerous.

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

A few of these programs consisting of the Internal Revenue Service Voluntary Disclosure Program (also known as Brand-new OVDP) and also the Streamlined Filing Compliance Procedures. Our company in global tax, and specifically as well as Call our company today for aid with getting compliant.