Given that crescent tax declaring functions supplying various which can cost you in the marketplace, it implies you are entitled to have our tax experts sustain regularly without paying price, so please call us today for any kind of help. Related.

Many considerably, the Final Rules remain to book on whether equity passions in international hedge funds, personal equity funds, and also other non-mutual business mutual fund are treated as economic accounts subject to FBAR reporting. The Last Laws put on foreign financial accounts preserved in 2010 and also subsequent years. FBARs for calendar year 2010 are due June 30, 2011.

The Final Regulations are substantively similar to the Proposed Rules, they make the adhering to explanations and alterations: The prelude to the Last Laws clears up that a monetary account is not “foreign” and is not subject to FBAR reporting if it is preserved in the United States, even if the account has foreign properties.

Final Regulations Issued With Respect To Fbar Filing … in Albany, Oregon

The Final Rules change the Proposed Laws to offer that a person will certainly not be dealt with as having a financial rate of interest in a foreign monetary account held by a foreign trust if the individual is an optional recipient or holds a rest passion in the trust, unless the individual is the count on’s grantor and also has an ownership interest in the trust fund.

e., a person assigned to route the trustees’ management of the depend on) that goes through the United States person’s straight or indirect guideline. According to the prelude to the Final Laws, Fin, CEN believes that the anti-avoidance regulation in the guidelines avoids making use of a trust fund guard to evade FBAR coverage obligations.

Part II supplies an overview of the FBAR rules. Component III defines individuals as well as entities required to file FBARs. Component IV describes the accounts that undergo FBAR reporting. Component V explains the kinds of economic passions in a foreign economic account that activate FBAR coverage. Component VI defines the signature or other authority that also causes FBAR coverage (including the exemptions from applying for particular individuals that have signature or various other authority over an international financial account yet no monetary interest in the account).

American Tax Advice: Do I Need To File An Fbar? in Panama City, Florida

Global Mobility Tax Strategy – Global Tax Services in Norwalk, California

Global Mobility Tax Strategy – Global Tax Services in Norwalk, CaliforniaThe regulations applying the Bank Secrecy Act normally call for everyone based on the territory of the United States that has a financial rate of interest in, or trademark or various other authority over, financial institution, safeties, or various other economic accounts in a foreign country to submit an FBAR for each schedule year if the accumulated worth of the accounts goes beyond $10,000.

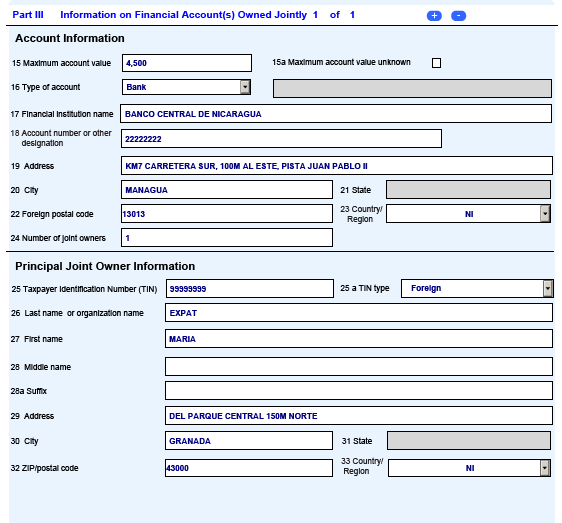

FBAR filers have to typically preserve a document of (i) the name maintained on each reportable account, (ii) the number or various other classification of the account, (iii) the name and also address of the foreign financial institution or various other individual with whom the account is kept, (iv) the kind of account, and (v) the optimum value of the account throughout the coverage period, for five years.

Persons Required to File an FBAR Only “United States individuals” are required to submit FBARs. A United States individual consists of: A citizen of the United States. A resident alien of the United States for U.S. federal income tax purposes, other than that the term “United States” includes any state, the Area of Columbia, the territories as well as insular belongings of the United States, and also Indian tribe lands.

Do You Need To File Foreign Bank Accounting Reporting? in Leesburg, Virginia

If a UNITED STATE person completely possesses a single-member residential LLC that, in turn, holds a rate of interest in an international monetary account, both the LLC and also its owner must submit different FBARs. Since the meaning of “United States person” under the FBAR regulations depends on where an entity is created, organized, or formed, as well as not where it carries out business, a foreign entity would certainly not be required to submit an FBAR, also if the international entity operates via a branch or various other irreversible establishment in the United States, even if the foreign entity is a “flow via” for U.S

How To File An Individual Fbar – Guides For Your Expatriation in Topeka, Kansas

The Final Rules do not include this exemption. We do not think that Fin, CEN planned to deal with equity rate of interests in entities besides shared funds as monetary accounts as well as we do not think that Fin, CEN meant to treat notes, bonds, as well as various other debt as economic accounts, unless the debt qualifies as a bank account or safety and securities account.

An account of a “United States armed forces financial facility” designed to serve U.S. governmental installments abroad. V. Financial Rate of interest United States individuals are called for to file an FBAR if they have a “financial passion” in a foreign financial account.

The owner of record or owner of legal title is functioning as agent, candidate, attorney, or in another capability on behalf of the United States individual. A firm is the proprietor of record or holder of legal title, as well as the United States person has (straight or indirectly) more than 50% of the corporation’s vote or worth.

Fbar Deadline Still April 15 For Taxpayers With Foreign Bank … in Bentonville, Arkansas

A depend on is the proprietor of document or owner of lawful title, and a United States person (i) is the depend on’s grantor and has an ownership interest in the trust fund for UNITED STATE federal income tax purposes, or (ii) either (A) has a present helpful interest in greater than 50% of the trust fund’s possessions or (B) gets more than 50% of the trust fund’s current earnings.

Thus, if a United States individual wholly has a foreign firm, as well as a 3rd party is the record owner of as well as holds lawful title to a foreign monetary account as the corporation’s agent, the Last Rules would not need the United States person to file an FBAR relative to that international monetary account.

However, the anti-avoidance policy applies just to an entity that was “created” for an objective of evading the FBAR policies, and only if the entity is the owner of document or holder of lawful title. The anti-avoidance rule does not show up to put on pre-existing entities that are made use of for violent functions and also does not apply if an entity is the useful owner of an international monetary account that is kept in the name of one more individual.

Taxpayer Beware: New Fbar Filing Deadline For 2016 in Denton, Texas

Trademark or Other Authority Any United States individual with trademark or other authority over a foreign monetary account is typically called for to file an FBAR with regard to that account. Under the FBAR regulations, a person is deemed to have signature or other authority over a foreign economic account if the person can control the personality of money or other residential property in the account by direct communication (whether in writing or otherwise, and whether alone or with the consent of various other individuals) to the person with whom the account is preserved.

An entity with a course of equity safety and securities or American vault invoices noted on a UNITED STATE nationwide safety and securities exchange, or a UNITED STATE subsidiary called in a combined FBAR report of a moms and dad entity that has a class of equity securities provided on a UNITED STATE nationwide safeties exchange. A U. S.

e., the entity has $10 million of assets as well as 500 or more investors of document). Nonetheless, no exemption is supplied for employees of independently held investment fund managers that are not registered with the SEC, UNITED STATE employees of foreign banks and funds, or employees of tax-exempt entities that do not otherwise fall under one of the above exemptions.

Delinquent Fbar And Tax Filing Penalties – Washington, Dc – in Wichita, Kansas

Special Regulations A United States person that has a monetary passion in 25 or even more international monetary accounts might submit an FBAR type that shows only the variety of monetary accounts and certain various other fundamental information on the FBAR report, if the United States person consents to supply comprehensive details regarding each account to the IRS upon demand.

Participants and also beneficiaries in retirement strategies under sections 401(a), 403(a), or 403(b) of the Internal Profits Code, as well as owners and beneficiaries of IRAs under area 408 or Roth IRAs under section 408A of the Internal Profits Code, are not called for to file an FBAR relative to a foreign monetary account held by or on part of the retirement or IRA. firpta exemption.

section 5321( 5 )(B)(ii). Affordable cause is unlikely to exist for a lot of unintentional failings to submit an FBAR. 31 U.S.C. area 5321( 5 )(C). 31 U.S.C. area 5322(A). It might be challenging to inform whether a count on is arranged under the regulations of a state. As an example, assume that 2 international individuals with no connection to the United States get in into a trust contract and offer that the trust agreement is controlled under Delaware law.

Foreign Bank Account Reporting,fbar. What Does It Cost To … in Clearwater, Florida

Global Tax And Accounting Software Market Research Report in Michigan City, Indiana

Global Tax And Accounting Software Market Research Report in Michigan City, IndianaFounded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

It is entirely unclear whether the depend on is a United States individual for objectives of the FBAR policies. As talked about below, the Final Rules book on the treatment of an equity passion in an international bush fund or exclusive equity fund. The prelude to the Proposed Rules discusses that the term “financial agency” is intended, in this context, to cover accounts in other countries that are comparable to bank accounts yet might have a various label or operate under a various lawful framework.

persons with foreign accounts ought to realize that there are numerous differences between the FBAR as well as Form 8938. Primarily are the different coverage limits. The FBAR needs to be filed when an U.S. individual has international savings account with an accumulated high balance of $10,000 at any type of factor throughout the tax year.

An Update On Foreign Financial Account Reporting – The Tax … in Gilroy, California

A single taxpayer residing in the United States should submit Type 8938 if her defined international possessions surpass $50,000 on the last day of the tax year or greater than $75,000 at any moment during the tax year. Those thresholds raise to $200,000 and $300,000, specifically, for a single taxpayer staying outside the United States.

For wedded taxpayers living outside the United States as well as filing joint tax returns, the Type 8938 coverage limit is $400,000 in defined foreign assets on the last day of the tax year, or more than $600,000 at any moment throughout the tax year (but just $200,000 and $300,000, respectively, if filing individually).

For FBAR purposes, ownership passion in an account, power of attorney over an account, or perhaps simply signature authority are each adequate for purposes of reporting the account. Furthermore, foreign accounts in which a person has an indirect but adequate beneficial ownership rate of interest (e. g., a greater than 50% possession passion in the entity that directly possesses the international account) needs to be directly reported on that individual’s FBAR.

What Is Fbar Filing? – Brager Tax Law Group in Huntington, West Virginia

International Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

Accounts in which the taxpayer solely has a power of attorney or just has signature authority do not need to be reported on Kind 8938. Furthermore, accounts in which the taxpayer has just an indirect rate of interest (e. g., through an entity) do not need to be reported on Kind 8938.