FIRPTA: What It Is as well as Exactly How It Functions Basically, when an individual markets a residential or commercial property in the United States, they are required to submit a UNITED STATE income tax return to report the sale. This is where the actual tax on the sale is computed. This 15% withholding is thought about a deposit that will be used to the actual tax which is calculated when filing a UNITED STATE

Upon comparing the deposit and the actual taxReal if the tax is tax obligation than the 15% withholding, the remainder is refunded to the seller.

Congressional Proposals Seek To Promote Foreign Investment … in Wausau, Wisconsin

For this to use, the buyer has to be a specific instead of a firm, estate, trust fund, https://Iwtas.com/services/real-estate-and-foreign-investment/ or collaboration. Vacant land is not qualified for this exemption also if the customer plans to build a home on the residential property (us inheritance tax for non us citizens). As an example, allow’s consider that a foreign person sells a UNITED STATE

Founded in 2015 and located on Avenue of the Americas, in the heart of New York City, International Wealth Tax Advisors provides highly personalized, secure and private global tax, GILTI, FATCA, Foreign Trusts consulting and accounting to many clients worldwide, including: Singapore, China, Mexico, Ecuador, Peru, Brazil, Argentina, Saudi Arabia, Pakistan, Afghanistan, South Africa, United Kingdom, France, Spain, Switzerland, Australia and New Zealand.

In this instance, the buyer intends to utilize the home as an individual home for 5 months out of the year on a continuous basis. The purchaser also plans to rent the building for three months out of each year. Throughout the continuing to be 4 months of yearly, the residential or commercial property will remain vacant.

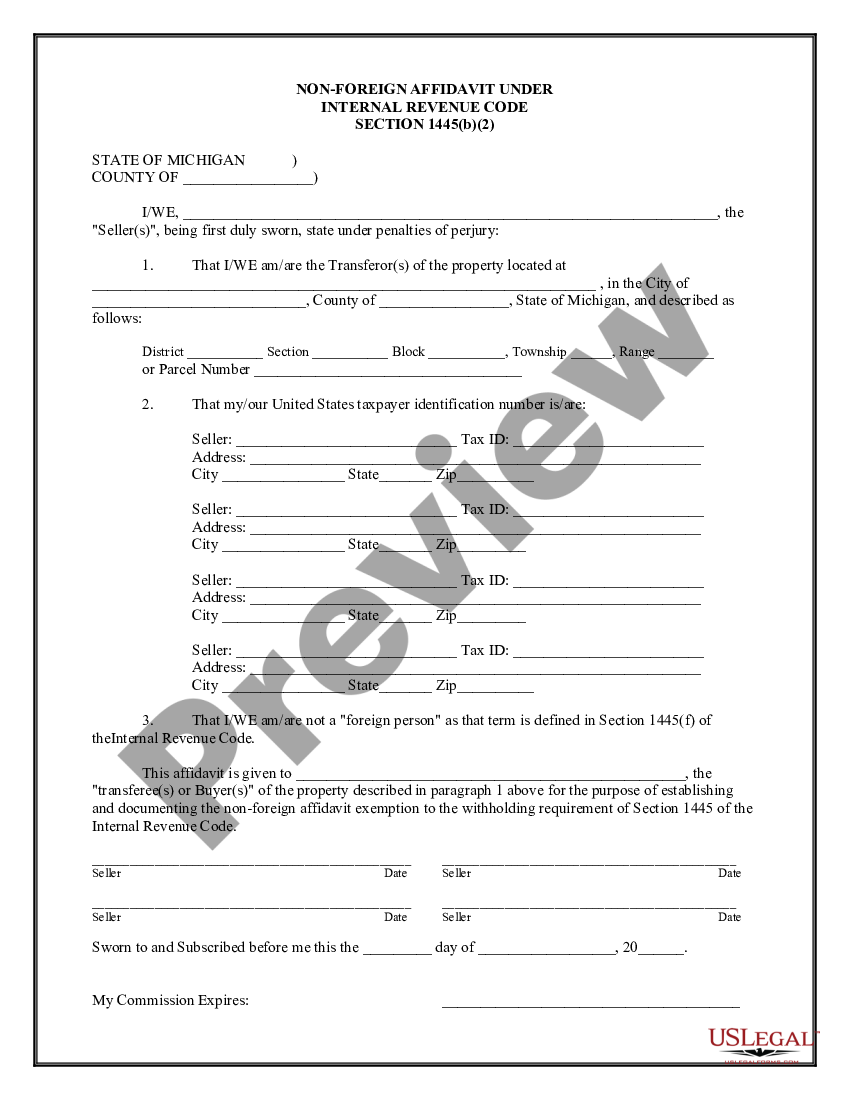

In this instance, however, the buyer should want to sign a sworn statement regarding their intentions under penalties of perjury. The vendor must still submit an U.S. earnings tax return reporting the sale as well as pay all suitable income tax obligations – us inheritance tax for non us citizens. Sales surpassing $300,000, whether at a profit or muddle-headed, do not qualify for an exemption.

Firpta Tax Planning Opportunities U.s. Real Estate Foreign … in Vallejo, California

In this case, as well, the customer has to sign a testimony under fine of perjury revealing their purposes. Making an application for a Withholding Certificate When Costing a Loss An additional essential piece of info to maintain in mind is that, when the real tax on the sale is dramatically less than the 15% withholding, the seller can make an application for a withholding certification from the IRS.

An individual acquired a property for $700,000. In this instance, due to the fact that the seller is sustaining a considerable loss on the sale of the residential property, no income tax is payable on the sale.

In this scenario, the vendor may send an application to the Internal Revenue Service documenting that the sale will result in a loss. Offered that the application is made no behind the date of closing, no withholding is called for. Since it generally takes the Internal Revenue Service 90 days to issue the withholding certification, the closing may take place prior to the certification is released.

Rather of paying the withholding to the Internal Revenue Service, the closing representative is able to hold the money in escrow till the withholding certification is released. Upon invoice of the certificate, the agent is after that able to remit the lowered withholding amount, if any kind of applies, as well as return the balance to the seller – us inheritance tax for non us citizens.

Firpta: Frequently Asked Questions – First American in Surprise, Arizona

Private revenue tax obligations are reported based on the fiscal year. There is much less factor to declare the withholding certification if the sale takes area in December as well as the income tax return might be filed in the close to future. In this instance, the funds would certainly be reimbursed a few months after the sale.

In this situation, relying on the amount due, it might be a good idea to make an application for a withholding certificate. In considering the terms of a short sale, where the quantity due on the existing home loan will certainly not be satisfied from the earnings of the sale, the 15% policy still uses on a residential or commercial property with a price over $300,000.

Accounting & Tax: The Global And Local Complexities Holding … in Weston, Florida

Accounting & Tax: The Global And Local Complexities Holding … in Weston, FloridaIn order to use for a withholding certificate, all parties included in the purchase should have a Tax Identification Number (TIN) or a UNITED STATE Social Safety And Security Number. Valuable sources discussed in this write-up: To locate out more regarding FIRPTA browse through: To find out more concerning Tax Recognition Numbers see: Sharing is caring!.

Memorandum – Fried Frank in Levittown, Pennsylvania

A USRPI typically consists of a rate of interest in genuine building located in the United States or the Virgin Islands, and any interest (apart from exclusively as a lender) in any US company unless the taxpayer develops that such United States corporation was at no time a “United States real home holding corporation”; during the five-year duration upright the date of the personality of the passion (us inheritance tax for non us citizens).

Area 897(l) gives that a QFPF is not treated as a nonresident alien person or a non-US firm for objectives of Area 897. Thus, a QFPF is exempt to US federal tax on the gain or loss from the personality of, and also circulations with respect to, USRPIs. A QFPF is any count on, company or other organization or setup that: is developed or organized under the law of a country aside from the United States; is established to provide retirement or pension plan advantages to participants or recipients that are present or previous employees; does not have a solitary individual or recipient with a right to even more than five percent of its assets or income; undergoes federal government regulation and also supplies, or otherwise provides, yearly information reporting concerning its recipients to the appropriate tax authorities in the nation in which it is established or runs; and also relative to which, under the regulations of the nation in which it is developed or operates, either (a) contributions to it that would certainly otherwise be subject to tax are insurance deductible or omitted from the gross earnings of such entity or taxed at a lowered rate, or (b) taxes of any of its investment revenue is deferred or such earnings is taxed at a lowered rate.

To fight possible misuse of the QFPF exemption, the Proposed Regulations offer that a QFPF or QCE does not consist of any entity or governmental unit that, at any moment throughout a certain “screening duration,” was not a QFPF, a part of a QFPF, or a QCE. For example, the Proposed Laws describe that if FC1, a non-US corporation that is neither a QFPF or a QCE, has 100% of FC2, a non-US firm, that possesses USRPIs, FC1 could market every one of the supply of FC2 to a QFPF without incurring any United States tax liability.

Global Tax And Accounting: International Wealth Tax Advisors … in St. Petersburg, Florida

Global Tax And Accounting: International Wealth Tax Advisors … in St. Petersburg, FloridaInternational Wealth Tax Advisors, LLC

1270 6th Ave 7th floor,New York, NY 10020, USA

(212) 256-1142

Click here to book a consultation with International Wealth Tax Advisors about foreign trusts, Form 3520, Form 3520-A, FBAR (FinCEN 114), Form 8938, Form 5471, Form 8621, distributable net income calculations, undistributable net income calculations and beneficiary statements, etc.

The “testing duration” is the quickest of (1) the duration beginning on December 18, 2015 and also finishing on the day of a disposition explained in Area 897(a) or a circulation explained in Section 897(h), (2) the 10-year period upright the day of the personality or the distribution, or (3) the duration throughout which the entity (or its precursor) was in presence.